Elon Musk Proposes to Buy Twitter in Defiance of Likely Imminent Order to Buy Twitter

Alright, as usual, first things are first, and first things are updates on other cases:

v. Argentina

Someone should probably check on Judge Preska. Seriously, someone go check on her and make sure she’s ok. We’re still waiting on a summary judgment ruling. People have asked me what this delay might mean for Burford, and the simple answer is that it isn’t clearly indicative of anything. My guess is that we’re dealing with a simple scheduling issue.

I noted in my first article on the Burford case that the parties have agreed trial will move forward 115 days after the summary judgment ruling. It wasn’t terribly surprising then that Judge Preska didn’t issue a ruling in August, as that would have put trial around Christmas. Maybe it’s an aversion to eggnog-fueled office party ragers, but you typically won’t find a judge anywhere near their chambers on or around Christmas.

115 days from today, however, is January 27, 2023. Maybe Judge Preska is planning to celebrate MLK Day with a week-long ski trip and didn’t want to cut it short for what is sure to be a lengthy trial. Even absent a bluebird expedition, Judge Preska has to figure out how to slot the trial somewhere between an ongoing criminal docket and a back log of civil cases due to Covid restrictions.

My prediction: Summary judgment will resolve some, but not all of the many outstanding issues. If I were to really go out on a limb, I think we’ll see a ruling which resolves the interest rate issue I described in my prior post, as this is a ripe legal issue which Judge Preska is able to dispense of without the jury. Regardless, I think we get a ruling very soon now that we’re talking about a 2023 trial date.

SmartSky v.

We have an update! Gogo has defeated SmartSky’s motion for a preliminary injunction. It wasn’t exactly the prediction of the century, but it does show that this lawsuit is not the slam dunk that SmarkSky may have thought (or communicated) it was. The ruling also denied Gogo’s motion to strike improper reply arguments.

Both parties issued press releases, and SmartSky has called Gogo CEO Oak’s comments on the matter “misleading.” All in all, it’s a lot of jawboning and little substance. has been relatively flat on the news, and down rather precipitously in the month of September.

What’s in store for October? Likely an abatement to the selling pressure, at the very least. Twitter user @ive_m5 was kind enough to bring to my attention the now-complete mandatory divestiture of 1.5 million of Blackrock’s shares in due to “inadvertently acquir[ing] beneficial ownership of more than 4.9%.”

v. Musk — AKA THE MAIN EVENT AKA THE THUNDERDOME AKA THE MUSKENING PART IV

What a day. What a week. What is the age of a soul of a man? I am a lifetime older.

Today Elon Musk proposed to purchase Twitter… again. Or rather, he proposed to abide by his original proposal. You remember—that proposal which was then memorialized in that merger agreement thing. Yeah, that. Elon has proposed to do that.

This is, at its core, nothing new (the 13D says it’s a proposal “subject to the terms and conditions set forth therein [the merger agreement]”). After all, Musk was as much bound by the terms of the merger agreement yesterday as he was today. His apparent acquiescence doesn’t really change that. And “apparent” it really is—until we see money in the bank, this could still be part of Musk’s tomfoolery. For what it’s worth, I do believe Musk is serious this time.

Musk has said publicly that he would close the transaction if Twitter’s 5% mDAU bot numbers were correct. Last week, we learned that even Musk’s own mercenary data scientists estimated the bot count to be 5.3% with a 90% confidence interval. In other words, within the margin of error. We also learned that these data scientists used some subcontractors to do some of their work, and that Musk’s lawyers don’t even know who these subcontractors were despite allowing them to access troves of sensitive Twitter data, but I digress. Rather than simply admit he was wrong and move forward with the deal—which would require humility and self-awareness—Musk doubled down and added argument that mDAU isn’t that great of a reporting metric in the first place.

So why has Musk suddenly decided to capitulate, with the Chancery trial just a couple of weeks away? It could be that his favorite lawyer, Alex Spiro, is going to have to either admit he was colluding with Mudge to produce the whistleblower report or perjure himself in an affidavit. However, that would require some level of empathy on Musk’s part, so that is, in my humble opinion, not the driving factor here.

More likely, Musk’s decision to close the transaction is because this litigation has already cost Musk quite a lot, and will only cost him more. The cost to Musk is not just monetary in nature (although between his legal fees and Twitter’s legal fees—the latter of which he’ll be paying in some form or another if he comes to own Twitter—along with the pre-judgment interest which has been accruing, the monetary sum is on the order of dozens, if not hundreds of millions of dollars). Musk has lost face, and continues to lose face each day. The facade of his futurism is crumbling.

For some time, Musk has had a monopoly on the impossible. There are 724 billionaires in the U.S. alone as of 2022, but Musk might be the only one who could walk into a VC firm on any given Tuesday with a hare-brained pitch to liberate humanity from our terrestrial confines via a rocket powered by our collective consciousness and walk out with a $1billion check encumbered only by a 0.1x liquidation preference. He seems to be wholly incapable of work unless it’s on a project which no one has yet dreamt or on a project at which everyone else has failed.

This gatekeeping of galaxy-brained thinking has given Musk a bit of an ego. How could it not? But while Musk claims he was a shy kid, he’s certainly gotten quite comfortable stepping into the limelight and taking credit.

His many fans only stoke these flames:

But as much as we like to believe some people have limitless potential, and as much as Musk would like to believe he is the singular savior of humanity, the evidence shows that Musk may be reaching his own limits. The notion that Musk is playing 4-dimensional chess while everyone else plays checkers might only true if the 4th dimension is one where losing is winning and perjury is a sport.

What’s the evidence to support these allegations against the “real life Iron Man”? There’s a ton of it. From the disappointing Tesla AI day last Friday to the poorly executed Boring Company tunnels to the possible Neuralink-sponsored monkey massacre, Musk can’t seem to get out of his own way.

The most recent, and possibly most damning evidence of Musk’s mitigated genius came last week in the form of a string of text messages, produced during the discovery process at the Chancery Court, between Musk and various colleagues, friends, and Twitter representatives. These messages, sent over the course of the Twitter merger negotiations and ensuing legal battle, paint Musk to be capricious, vindictive, and surrounded by “yes"-men of unrivaled greed, idiocy, and moral turpitude. They are almost certainly a contributing factor to Musk’s decision to settle.

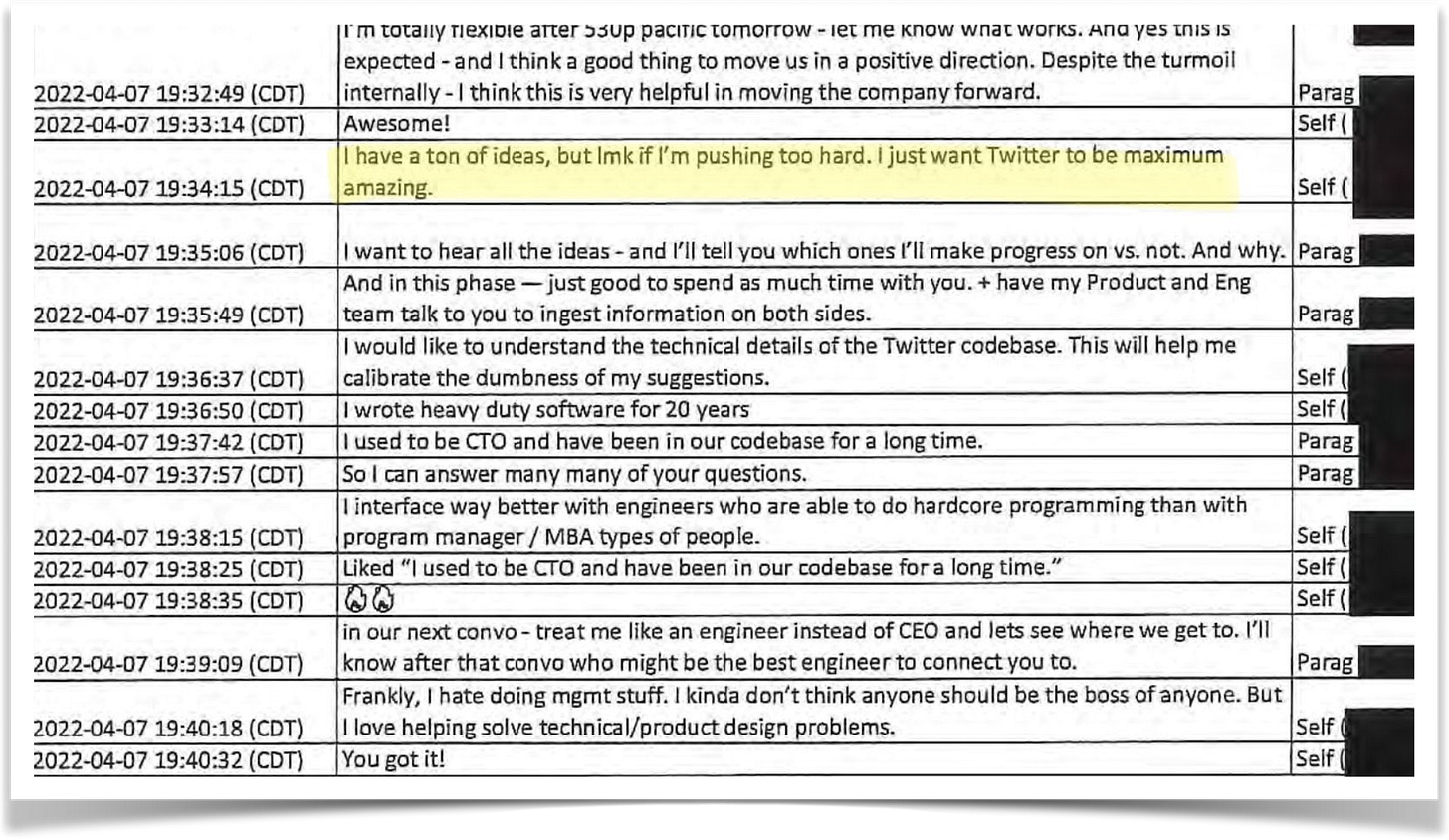

In one text exchange in early April, Musk tells Twitter CEO Parag Agrawal—the man who was promoted to CEO from CTO—that he “[has] a ton of ideas,” because he “want[s] Twitter to be maximum amazing.” Musk brags that he “wrote heavy duty software for 20 years,” again, to the guy who was promoted from CTO.

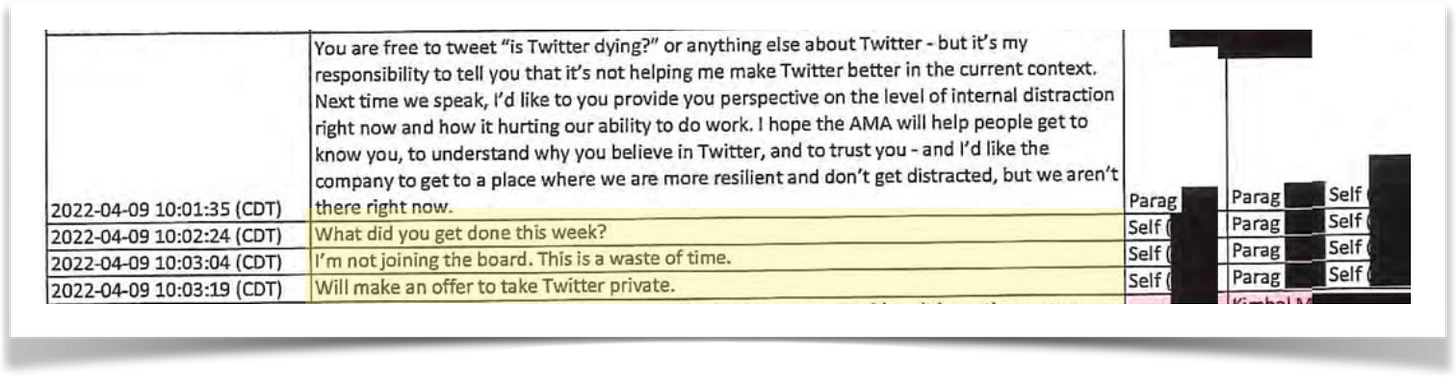

In another exchange from prior to Musk’s take private offer, Parag respectfully tells Musk he is free to tweet as he wishes about Twitter, but that as a possible new board member, Musk was becoming a distraction to the company with his aggressive tweets. Musk goes nuclear exactly 49 seconds later:

Other brilliant text messages from the discovery process include:

Jack Dorsey, famously rich from creating Twitter, telling Musk that Twitter should be an open-source protocol and definitely not a company. Musk would later offer $44billion for the thing that shouldn’t be a company:

Kimbal Musk, famous for being Elon’s brother and also for being an armchair-cowboy-chef-kinda-dude, establishing that he is actually the world’s foremost expert on all things web3. Kimbal’s brilliant idea for the revitalization of Twitter is that you will use real money to pay for tokens and then use these tokens to tweet and that users will somehow like this better than Twitter because they won’t have to deal with ads but also there are “some good ads out there.” SOMEBODY GET THIS MAN A TED TALK:

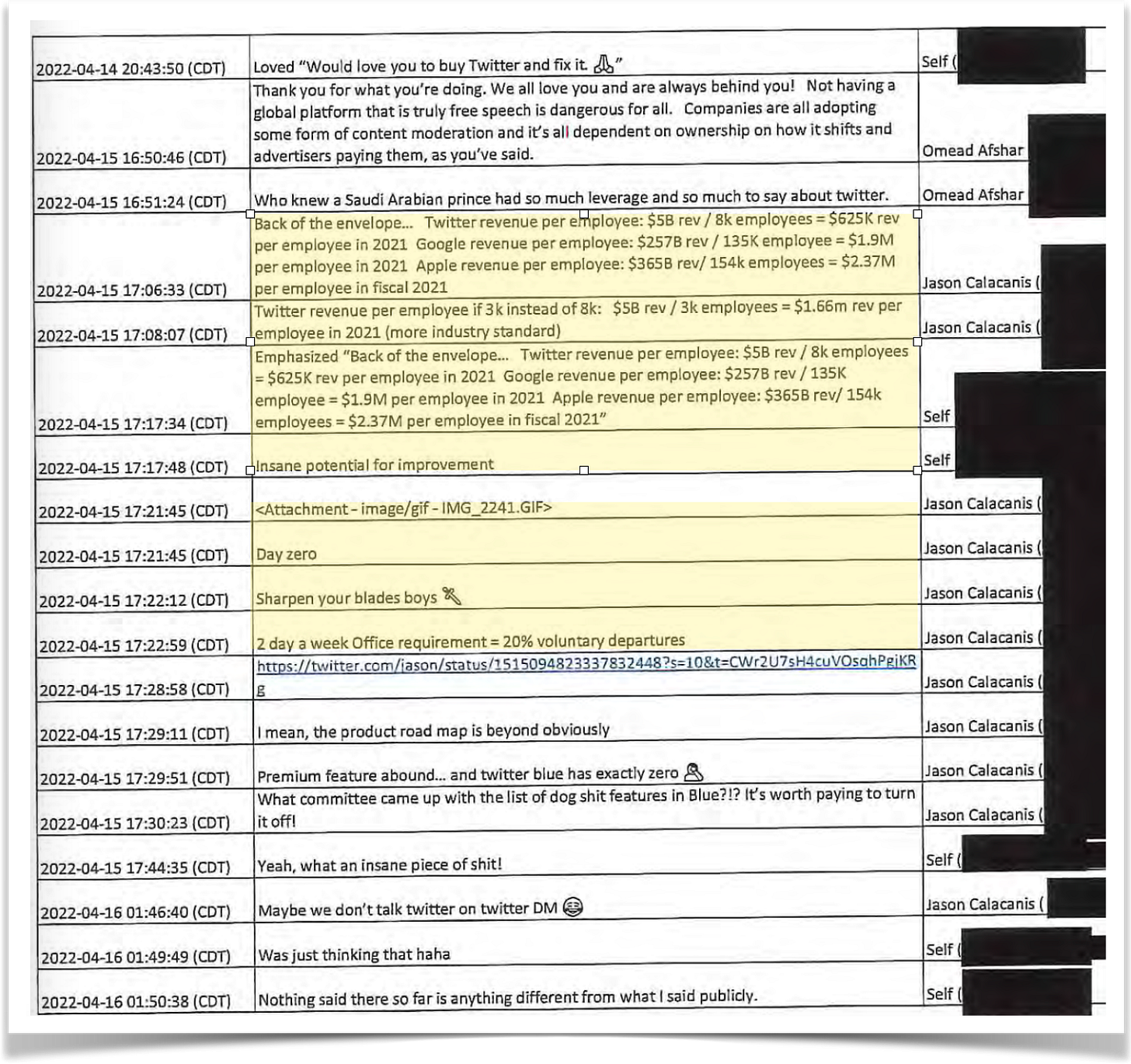

Jason Calacanis, famous for being in the right place at the right time, getting absolutely abused by Musk and begging for more after Musk tells him his SPV to raise equity from “randos” is an embarrassment, shortly after telling Calacanis that it was totally cool for him to create an SPV to raise equity from randos. Calacanis, ever the obsequious underling, patches things over with Musk by telling him he is Musk’s “ride or die brother,” and that he would “jump on a grande[sic] for [Musk].”

Jason Calacanis, also famous for giving his money to private companies in exchange for equity in said companies, slowly figuring out that investing in private companies and investing in public companies are different things. He’s never done a take-private, but I mean, how hard can it be??

Jason Calacanis, also famous for a podcast where he and 3 other future SEC defendants talk confidently about SPACs, politics, and macroeconomics with the help of a crystal ball commonly known as hindsight bias, sharing his brilliant plans for 5x’ing Twitter. Barbarians at the gate, beware! There’s a new king of the castle and he’s “sharpen[ing his] blades.” I bet Parag doesn’t understand denominators like Calacanis—he would have fired 1/3 of the Twitter staff a long time ago if he did!

Elon Musk, famous for being the best at everything, noting that his plan for the new Twitter is that the company structure will include exactly zero managers, and that he will oversee all… like… what… 2,000(??) engineers at Twitter himself. Directly. This is exactly the kind of thing you hope to see from a guy already “running” four multi-billion dollar companies.

Reading through the text chains, you might be asking yourself, “Can these messages from these titans of industry be real??”

Yes, yes they are.

Ok, maybe they aren’t spectacular. Maybe they’re a sad commentary on the state of Silicon Valley and the dangers of unyielding faith in charlatans whose only qualification is hubris—grifters whose successes are measured in revenue-related KPIs, and whose failures are measured in the number of pension funds they’ve blown up. I don’t know. It’s 1am, I’m two manhattans deep, and I’m feeling pensive.

I have to confess, despite my better efforts, I have watched with near giddy joy at times while Musk’s castle has begun crashing down around him. I didn’t start out this way. My motivation for entering this investment was simply that I saw an under-appreciated arbitrage opportunity. The opportunity was as much in the legal analysis of the merger agreement language as it was in the mere fact that no one believed the unstoppable force of Elon Musk could ever face an arbiter who could force his hand. People underestimated the Chancery Court. People underestimated Kathaleen McCormick.

My joy in this proceeding is almost certainly an unhealthy mindset when money is on the line, and my money is still on the line. The best investing mindset is neutral. But my conviction remains strong that this deal will close. Whether I sell for $52+ or wait for the $54.20 is really just a matter of principle at this point. At the end of the day, I’m just a pawn in Mr. Musk’s game. But I’m a wealthier pawn than I was yesterday, and I’ll take that.

I have not sold any since my last update, but I expect I will sell at least some of my position this week. To all those who have followed on this ride, thank you for your subscription and your support—both here and on Twitter. And congratulations on any profits you have made or may yet make on this deal. I am continuously on the lookout for other litigation arb opportunities and will continue to write and update on an ad hoc basis, for now.